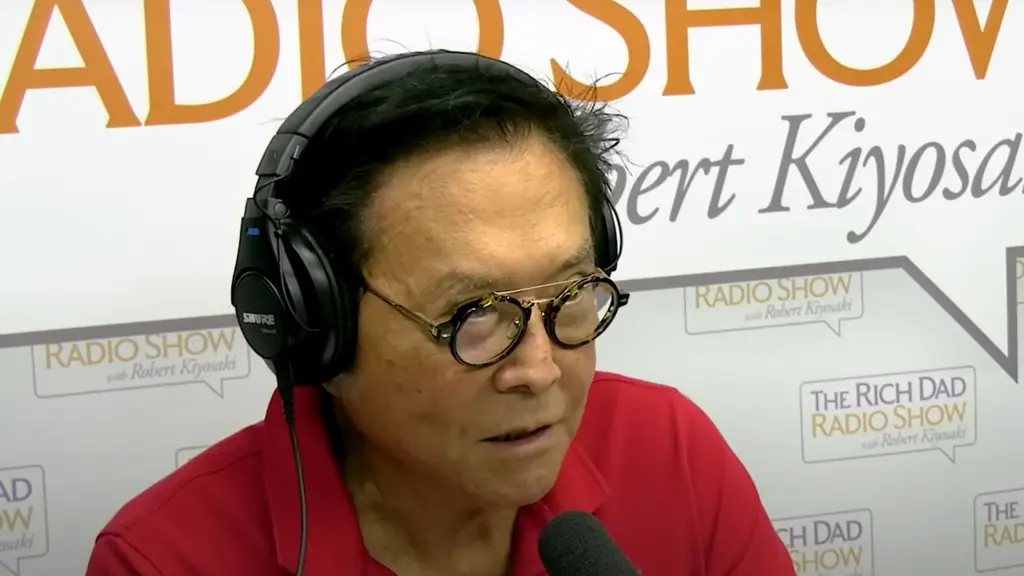

'Rich Dad, Poor Dad's' Robert Kiyosaki Says He's $1.2 Billion In Debt Because 'If I Go Bust, The Bank Goes Bust. Not My Problem'

'Rich Dad, Poor Dad's' Robert Kiyosaki Says He's $1.2 Billion In Debt Because 'If I Go Bust, The Bank Goes Bust. Not My Problem'

finance.yahoo.com

'Rich Dad, Poor Dad's' Robert Kiyosaki Says He's $1.2 Billion In Debt Because 'If I Go Bust, The Bank Goes Bust. Not My Problem'